Q4 and full-year results

Hershey bets on multi-textural snacking and Chinese e-commerce for growth

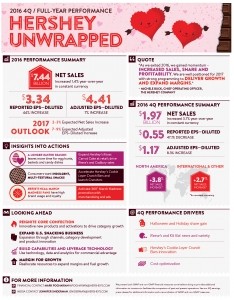

Hershey posted net sales of $1.97bn during the quarter, a 3.2% increase year over year. This marks the third straight rise in quarterly sales after a few quarters of no growth, said investment research firm Zacks.

Full-year net sales were $7.44bn, up 0.7% from $7.39bn a year ago.

Chocolate drives CMG growth in US

“Looking at market place performance, our core US CMG (candy, mint and gum) and snacks businesses progress as we anticipated,” Hershey’s current CEO John Bilbrey said during the conference call.

“Our Q4 US chocolate performance was solid with retail takeaway seeing an increase of 2.9%, resulting in a chocolate market share gain of 0.9 point,” Bilbrey said.

“Retail takeaway and market share performance in the second half of the year was better than the first half of the year, which was impacted by shorter Easter and merchandising display strategy. This results in full-year snacking market share growth of about 10 basis points.”

During the full year of 2016, Hershey gained 0.4 points in share of the US chocolate market thanks to the investment in core brands, including Reese’s and KitKat, Bilbrey said.

Reese’s is our biggest brand continues to gain momentum driven by variety, news, and in-store merchandising display, he said. The brand’s retail sales increased 7.2% in Q4, similar to the previous quarter.

“In 2017, we’ll look to expand and improve upon our NCAA basketball and football relationship,” Bilbrey added.

In addition, the sales increase during the quarter was also driven by the product innovation such as the Big Kat.

Hershey has also launched a red velvet-flavored KitKat coated in white cream for Valentine’s Day this year.

However, Hershey was not satisfied with its US performance of the Brookside brand, which the confectioner introduced to the Indian market for the first time this year.

“We believe CMG has potential long-term growth with the right retail and consumer marketing,” Bilbrey said.

Director of insight of Mintel food and drink, Marcia Mogelonsky, said: “The sugar and gum issue was not extensively addressed by the [Hershey] company, and there is definitely a need for something to happened in that segment.”

Declining overall international markets due to China

Hershey’s North America net sales rose 3.8% to $1.69bn in Q4, while its 'International and Other' segment declined 0.5% to $280.1m mainly due to the struggling Chinese market.

“International markets are relatively in line with expectations,” Bilbrey told investors during the call. “I’m particularly pleased with Mexico and Brazil where we generated solid constant currency of net sales growth.”

“In Brazil, the growth is driven by distribution gain of our core brands and continuous rollout of the Hershey’s special milk and Hershey’s special dark bars which were launched in Q3. As a result, in Q4, market share [in Brazil] increased 0.5 point.”

He added the net sales of Hershey’s Mexican and Indian businesses also grew by 9.5% and 20% respectively in Q4.

However, sales remained under pressure in China with Hershey’s chocolate category sales declining about 4% and its overall sales declining about 11% during Q4.

Hershey said Q4 net sales in China were “slightly below” forecast due to challenges in modern trade given the macroeconomic environment.

To revive its Chinese business, Hershey has taken advantage the Chinese New Year and the booming e-commerce platform. It reported the sales during the 2017 Lunar New Year have been positive, and its market share on e-commerce is expected to surpass brick-and-mortar this year in China.

In the meantime, Bilbrey said Hershey has begun a strategic review of its global cost structure that should result in solid margin expansion and EPS growth. The firm will share a more detailed plan at its investor update on March 1, 2017.

Multi-textural snacking is key to incremental growth

Consumer demand for multi-textural eating experiences across snacking occasion is increasing, according to Hershey’s market research.

Profit performance

Hershey’s reported net income:

- Q4 - $116.9m, -49%

- Full-year 2016 - $720m, +40%

“Our research indicated Millennials want new flavors and textures, especially the Reese’s consumers,” Buck said. “Reese’s is the fastest growing, and largest instant consumable franchise, so we do a lot of work here, trying to bring a right level of investment.”

“The launch of Hershey’s Cookie Layer Crunch is underway, and we believe this will energize the brand,” she added. “Distribution is now being built, and advertising is scheduled to begin in early February… You will also see similar Reese’s crunchy cups and Hershey’s crunches [coming to the market this year].”

Currently, Hershey’s Cookie Layer Crunch offers three varieties, including vanilla crème, caramel, and mint. These varieties are considered relatively “safe flavors” for Hershey, Mogelonsky said, “and it is likely that the company will be introducing more extensions.”

“In 2017, we’ll launch Reese’s crunch cookie cup and instant consumable cup pie,” Buck said.

Hershey expects its net sales to increase by 2% to 3% this year, including an acquisition benefit of 0.5%.