M&A

Tea Squares faces possible acquisition after securing Whole Foods shelf space

CEO Jordan Buckner launched the company about a year ago to “create healthy and energizing snacks for on-the-go consumers looking to get more done during the day.”

He claimed Tea Sqaures is one of the few brands that uses tea as an energy ingredient in the US snack market.

“A lot of the snacks in the market are designed to alleviate hunger and fill people up, or they are rich in protein to fuel workout,” Buckner said.

“There are also a couple of snacks that use coffee as a natural energy source. But, tea is much better in providing a sustained focus boost because it helps avoid the jitter and energy crash [supposedly] caused by coffee.”

Tea Squares are made with ancient grains and comes in three variants, including acai blueberry with black tea, citrus green tea matcha and Madagascan vanilla tea.

Each bag of squares retails for $6.99. Buckner also mentioned the company is now developing a new bite size that will retail for $3.99 per 2.15-ounce pack.

Natural-positioned snacks

Tea Squares competes mainly within the natural snack space, as the segment has outgrown the overall snack category, said Buckner.

According to Steve Gaither, president of marketing consultancy JB Chicago and a partner of Spiral Sun Ventures that partly funded Tea Squares, “When you look at snacking, most of the time, it’s that three o’clock play of ‘how can I power through lunch to the end of day’?”

The snacking category for adults is growing massively, and infusing the energizing component is a strategy to fuel that growth, he added.

“[Tea Squares] is using a millet that is a better-for-you component, and brings in an energy source (tea) that people trust. Both tea and snack categories are growing tremendously," said Gaither.

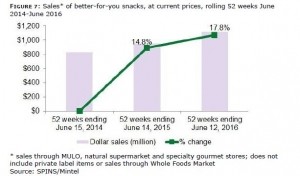

According to a recent webinar hosted by the National Confectioners Association, Spins, analysts noted snack sales are growing more than twice as fast in the US specialty gourmet retail channel than through mainstream stores.

Natural-positioned snacks, in particular, are driving the growth of the specialty channel, Spins analysts added.

Cookies and snack bars in the US specialty gourmet retail channel have grown by 7.6% year-over-year, meanwhile, energy bars and gels have grown about 13%, said the association.

Advantages of being small

Buckner previously worked as a consultant for major US snack brands before starting his own business, he told BakeryandSnacks.

He said he found the large companies are good at creating a product and getting it on shelves across the country really fast, but there are many disadvantages associated with it. For example, many of these companies often lack innovation and fall behind on consumer trends.

“When they develop a new product, it’s usually been in their pipeline for two to three years,” he said.

“Being a smaller company, we’re a lot nimbler. We make decisions without any layers of bureaucracy, so we can identify new trends and get them onto the market quickly.”

Looking for partnership

That said, Tea Squares is concerned its limited distribution sources could prevent it from stepping into the national spotlight.

“It’ll be great to have a strategic partner that has the distribution and sales capacity to bring Tea Squares to a larger audience.”

“[Our proposed partner] might acquire Tea Squares, or they may invest in our business to get an early advantage in the market,” Buckner said.

However, finding the right business partner might only take place in the next two years, he added.

Tea Squares hopes to triple its business by expanding distribution to the entire Chicagoland, including suburban market and all natural channels, by the end of 2017.