Commodities

The cereal report: what’s in store for 2017?

According to chief economist Bluford “Blu” Putnam, chief economist for the CME Group, last year’s Brexit referendum and the US elections particularly highlighted the volatility of today’s society, and how unreliable opinion polls could be.

In Putnam’s report, “Seven of the Most Noteworthy Trading Days of 2016,” he wrote that the focus on political event risk was shifting and commodity markets were in a tug of war between demand and supply forces pulling in opposite directions.

Pushing up prices

However, higher-than-expected US exports, favourable South American weather and Brazilian politics combined to push up the price of corn, he stated.

His report illustrated that, in April last year, a string of rainy days in Argentina coupled with dry heat during pollination in Brazil made US corn and soybeans more attractive.

On the political side, the impeachment proceedings against Brazil’s then President Dilma Rousseff, and the country’s decision to eliminate its corn import tax, also played a role.

The CME Group noted that these events brought about an all-time daily record of over 2.99m contracts changing hands on April 21, 2016, well over twice the typical average daily volume of 1.3m for agriculture futures and options products.

In fact, wrote Putnum, volumes the entire week – from the lowest of 2.56m on the 19th to the high on the 21st – were remarkable, and trading activity was seen coming in not just from the US, but also from all over the world for corn, soybean wheat.

Cereal changes

For now, there is expectation in the air for 2017, and cereals are one of the commodities to watch, report ING Bank strategists.

Hamza Khan, head of commodities strategy, however, believes that the grains market will remain under pressure this year, as weather will continue to be a key risk.

After the havoc caused by El Niño last year, weather experts warn that a developing La Niña could result in colder-than-usual waters along the equator, as well as in the northern regions of the Pacific Ocean, shifting weather patterns yet again.

Record inventory levels, though, are predicted.

Khan quoted the International Grains Council (IGC), which expects the US to produce a record harvest for corn and soybeans; Brazil is set to also outperform with its soybeans; and Australia will bring in the biggest wheat crop ever, thanks to current ideal weather conditions.

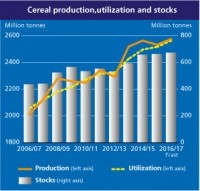

These figures were confirmed by the UN Food and Agriculture Organisation’s (FAO) most recent Cereal Supply and Demand Brief, in which it raised 2016 world cereal production forecasts to 2,577m tons, up 6m tons from November and 1.7% above last year’s output of 2,621m tons.

The FAO puts world wheat production in 2016 at 749m tons, 2.6m tons above previous expectations and 14m tons (1.9%) more than in 2015.

World maize production was also raised by 21% to 1,027m tons, 21.4m tons higher than in 2015.

In the northern hemisphere, the FAO reports the planting of the 2017 winter wheat crop in the EU is nearly complete under generally good conditions; beneficial weather in the US has improved crop conditions compared to the same period last year; and Russia, Ukraine, India, Pakistan and China are all enjoying similarly positive weather conditions.

The Ministry of Agriculture of Russia reports a record harvest of grain in Russia in 2016 of 124m tons.

Countries in the southern hemisphere – including Argentina, Brazil and South Africa – will also see improved returns as favorable weather conditions boost production output.

Exceeding last year’s high

This means that world trade in cereals in 2016/17 is forecast at 388m tons, down just 2% from the 2015/16 volume. The reduction stems mostly from the expectation of lower imports of maize, barley and sorghum by China.

Conversely, world wheat trade in 2016/17 is envisaged to exceed the previous season’s high level by 0.4%, reaching a new peak of 168.5m.

According to Khan, there appears to be no let-up in global grains production, dependent, however, on the prevalence of ‘normal’ weather.

“The market is going to have to keep a close eye on the conditions,” he said.