Dessert mixes: How to target a generation who can't bake

Deborah Cross, food industry analyst for Euromonitor, said that the dessert mix market tends to be relatively “staid” in developed markets, but growth potential exists in these countries and in emerging economies if manufacturers are willing to innovate.

"Lost generation”

Consumers in markets like Canada and the UK prefer baking from scratch, which could be related to a culture of celebrity chef programmes and accompanying cook books, Cross said in a Euromonitor Industry Insights blog.

She said that busy, working parents and labor-saving hardware and products like microwaves and ready meals have led to a process of de-skilling and a “lost generation” whereby tradition and baking knowledge may not have been passed down.

“In 2013, consumers in many countries still cook but have little time to prepare foods like cakes, so dessert mixes remains a versatile category, allowing store cupboard products to be easily whipped up as finished desserts and off-the-shelf baking solutions in response to an unforeseen event.”

Perceived nutrition and health

Cross said that longlife dessert mixes tend to be viewed as being of lower nutritional quality than some other processed packaged foods.

Innovation to improve this perception of nutrition and health would be of “immense benefit” for the category, she said. This could be done by adding in more functional ingredients or additional fiber by including nuts and fruits in separate ingredient pouches in the packs or whole grains in the mix itself, she added.

While indulgent products remain popular, Cross said that a wider cross-section of consumers could be targeted by focusing on healthier cakes or smaller portions.

This opportunity also extends to the trend of natural artificial colorings or flavors, she said, as seen by the strategy adopted by Green’s Foods Ltd, which holds a 22% value share of the category in Australia.

Strength in numbers

Co-branding could be another way of adding value to the segment, Cross said. She gave the example of Unilever Food Solutions that offers a dessert mix exclusively for professional chefs through a New Zealand foodservice channel. The product is in conjunction with the Carte d’Or ice cream brand and is an example of using another brand to endorse value and quality across both, she said.

“Co-branding dessert mixes allows an alternative to having to promote one’s own recipe ideas,” she said.

“Such innovations could help to reinvigorate the category in developed markets.”

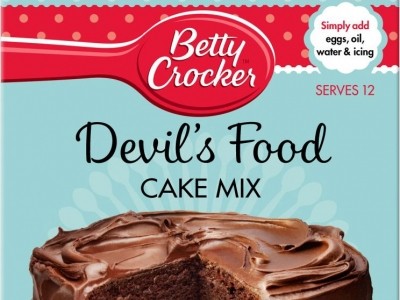

In September this year General Mills’ Betty Crocker brand paired up with chocolate manufacturer Hershey to combine brands like Reese’s peanut butter and chocolate with baking formats like cookies, cupcakes and frosted icing products.

Where is the growth?

The US is the largest market for dessert mixes, accounting for 28.5% of total retail value sales and 35% of volume sales, but Cross said this remains relatively flat. According to Euromonitor data, the top markets in terms of volume sales growth for dessert mixes between 2008 and 2013 were China, Turkey, India and Iran.

“Looking forward to 2018, markets within Asia, Eastern Europe and Latin America will continue to drive overall volume and value growth in dessert mixes, particularly Iran, Tunisia, Serbia and Indonesia,” she said.