If Bright Food takes over Weetabix...

Last week, Sky News reported Bright was poised to buy the remaining 40% shares of Weetabix from UK private equity firm Lion Capital. Lion Capital allegedly exercised a put option on its shares – the right to sell shares for a specified price by a predetermined date – to sell to Bright.

BakeryandSnacks.com contacted Lion Capital and Weetabix but both refused to comment on what they described as “speculation”.

However, a spokesperson for Weetabix expanded: “This is a matter for shareholders. Bright Food’s investment in Weetabix has created a global partnership, helping us grow internationally and our factories in Northamptonshire continue to export to around 80 countries worldwide, as well as servicing our UK retailers and consumers.”

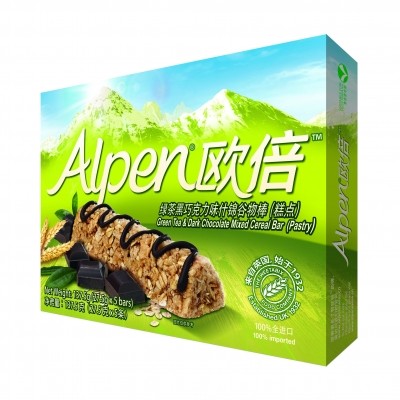

In March, 2014, Weetabix announced new product development efforts were underway for the Chinese market, aided by China’s food major Bright Food via its controlling 60% stake. In September, Weetabix launched a range of Alpen Bars tailored to consumer needs in the market, including green tea and dark chocolate bars.

What would a full buyout mean for Weetabix?

James Roy, associate principal of China Market Research (CMR), said should Bright shift its controlling stake to full shares, it would inherit a “stable of established international brands”.

He said Bright could learn plenty from the company’s branding practices and processes, particularly in overseas, developed markets.

Asked if a full buyout would tarnish Weetabix’s image in China – a country where Western-owned brands were highly considered – he said: “I don’t think the acquisition will negate the ‘western brand’ factor in Chinese consumers’ eyes.”

“For most people who know Weetabix, it will still be a brand with UK heritage, and that’s something Bright should continue to play up in its marketing. But the challenge is less about the origin of the brand and more about the appeal of the product itself,” he continued.

Roy said the opportunities for cold cereal in China, for example, remained limited as consumers preferred hot foods for breakfast.

Kevin Verbrugen, marketing manager for global brand development at Weetabix, previously told this site that was a challenge it was aware of and something that had prompted NPD efforts to consider flavor and texture preferences across the country.