'War on sugar’ fosters change for global candy industry: Euromonitor

“Consumers have greater awareness of ingredients used in food production and are more cautious on their consumption,” the market research firm’s food analyst, Jack Skelly, said during a recent presentation, titled “No Sugar Please: How Snacks Are Being Redefined,” in London.

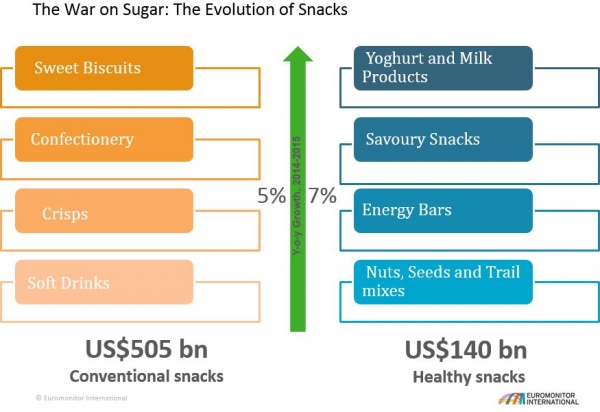

Growth of healthy snacks rose by 7% in the period of 2014 to 2015, compared to conventional snacks, which increased by 5%, according to the presentation.

Conventional snacks, which include sweet biscuits, confectionery, crisps, and soft drinks, are worth around $505bn worldwide; meanwhile the healthy snacks sector, which comprises nuts, seeds and trail mixes, energy bars, savory snacks, and yogurt and milk products, is valued at $140bn.

“The growth in healthy snacks was driven by Western Europe and North America, which combined, increased by $10.8bn from 2011 to 2016, an emerging trend that could transform the industry,” Skelly said.

Health trend fosters business strategy shift

The “demonization of sugar” inevitably created a change in the type of ingredients used in confectionery and snack products, Euromonitor’s ingredients analyst, John George, said.

The sugar-reduction movement has caused manufacturers to use increasing amount of sugar replacers or natural sweeteners instead in their new products.

“In 2015, global sweeteners use in conventional snacks amounted to 15.5m tons, while in comparison, new snacks included less than a fifth of this at 3m tons,” George said.

The health trend not only fosters a shift in ingredients for the packaged food industry, but also a new pack sizing strategies, added Karine Dussimon, senior packaging analyst at Euromonitor.

“We’ve seen an increasing polarization of pack sizes in conventional snacks, as larger formats are marketed for a shared consumption, and smaller sizes, more commonly launched as calorie packs,” she said. “The aim of these new formats are to convey greater portion control and lower guilt of buying a treat while boosting impulse purchase.”

Chocolate candy and gum sectors responds differently to sugar-free

ConfectioneryNews analyzed sales data for multiple US outlets, including C-stores and mass market retailers from analysts IRI for the 52 weeks up ending on August 7, 2016.

The dollar sales of the sugar-free chocolate candy category have increased by 3.04% compared to the previous year, reaching $116m in total. Among the top sugar free chocolate brands in terms of dollar sales, Lily’s Sweet leads the category with a 69.65% dollar sales increase versus last year.

Meanwhile, the total chocolate candy category, was valued at around $14bn and only increased by 1.61% in dollar sales compared to the same period last year.

Sugarless Gum Companies | Dollar Sales | Dollar Sales % Change vs a year ago |

Wrigley | $1,397,740,672 | 3.01% |

Mondelēz | $853,781,504 | 5.92% |

Hershey | $185,021,456 | 20.03% |

Perfetti Van Melle | $171,808,928 | 19.67% |

Project 7 | $7,016,243 | 154.59% |

Source: IRI (total US multi-outlets; latest 52 weeks ending Sept. 4, 2016)

However, according to latest IRI data for the 52 weeks leading up to Sept. 4 this year, the gum category in the US responds differently to the sugar-free movement: sugarless gum, which values $2bn more than regular gum, only increased by 1.27% in terms of dollar sales compared to last year, while regular gum increased by 1.65%.

With the sugarless gum category, Project 7 dwarfed all major gum players in terms of dollar sales growth, including Wrigley, Mondelez, Hershey and Perfetti Van Melle, with a 154.59% increase compared to the same period last year, according to IRI data.

Gum industry cuts sugar despite slower growth

In spite of the slower growth of sugarless gum compared to regular gum products, gum manufacturers still see the increasing consumer health awareness as a business opportunity.

Earlier this year, the oldest gum company in the US, Bazooka Candy Company, launched its first sugar-free gum, packaged in 60-count to-go cup and 22-count slim tube formats. The new product is sweetened with sorbitol-based sweetener system.

The company also recently partnered with Disney and Marvel to feature their characters on its sugar-free products’ packaging.

“Bazooka Sugar Free is the only current sugar-free product in the Bazooka Candy Brands portfolio,” marketing director for Bazooka, Nicole Rivera, told ConfectioneryNews.

Even though sugar-free products, as a whole, are still a small percentage of Bazooka’s total business, the company continues to see month-over-month growth “signaling heightened consumer interest,” Rivera added.

“Consumers are increasingly aware of the importance of healthy weight in prevention of diabetes and other diseases, so minimizing sugar and calorie intake is high on consumers’ agenda,” head of health and wellness research at Euromonitor, Ewa Hudson, said.

Emerging markets drive sugar consumption growth

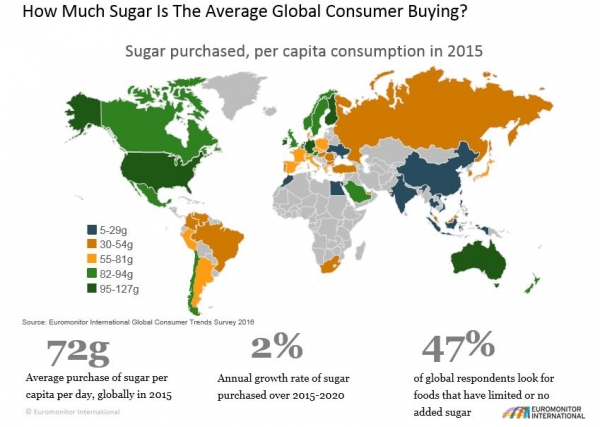

Euromonitor data shows that the average global consumer purchased 34 grams of sugar per capita per day in 2014 from packaged food and beverages, with the US topping the countries list.

“Assuming the sugar content of food and beverage products stays the same and based on forecast volume sales, the world will be buying two grams more sugar per capita a day by 2020, with emerging markets driving this growth,” Euromonitor said.