How NPD is helping to drive the popcorn boom

Total UK popcorn sales have grown 13.6% year on year by value to £120m ($156m) compared with a 1.7% decline in value sales of potato chips [IRI 52 w/e 16 July 2016].

With UK consumers show a big appetite for popcorn, US snacks firms including Snyder’s-Lance and Amplify Snack Brands are looking to ramp up their presence in the market (see box-out below).

It has also helped ensure a steady stream of NPD in the UK, in contrast to a drop-off in new product development in the wider UK grocery market.

As previously reported by this site, UK retailers have been rationalizing product ranges to reduce duplication and boost margins in the face of the growth of discounters such as Aldi and Lidl.

The total number of new branded items launched in UK grocery in 2015 was 13% lower than in 2013, found IRI.

This has contributed to the proportion of total food sales generated by NPD falling 1.2 percentage points since 2011 to 1.7%, while NPD has accounted for 2.7% of popcorn category sales - well ahead of most food categories.

“Manufacturers across categories are under pressure from retailer range rationalisation and we’re just not seeing NPD investment,” said IRI strategic insight director Tim Eales. “But for popcorn it is a different story, with new products hitting the shelves frequently and doing really well.”

Top five UK popcorn brands

Popcorn has become a trendy, healthy snack eaten at a range occasions, he added.

“Manufacturers and retailers have found a way to collaborate and champion the right innovative NPD. Unusual flavours, its healthy snack positioning and quirky packaging are just some of the ways they’ve done this and it’s really paying off.”

IRI said notable launches included Wholegrain Sunbites ready to eat popcorn – produced under PepsiCo’s Walkers brand - that have achieved sales of just under £1.1m ($1.4m) since launching in February this year.

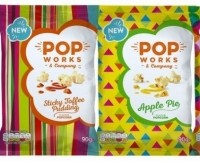

This month, PepsiCo expanded its UK presence with a UK roll out of the Pop Works & Company brand – which is also available in other markets. The UK line-up comprises four flavors - Sticky Toffee Pudding, Peanut Butter & Caramel, Apple Pie, and Sweet & Salty – that are sold in 90 g bags with a recommended retail price of £1.50 ($2).

“Shoppers are increasingly concerned with healthiness, a trend we are seeing across FMCG categories, said Eales. “Popcorn is low in calories and full of protein, and therefore fulfills shopper demand for a healthy snack alternative to crisps.

Nuts were also benefitting from demand for higher-protein snacks, according to IRI, and were out-performing many other parts of the snacks category.

Eales flagged up Propercorn’s Corn Crunch – a recently launched range of half-popped, crunchy popcorn – as being halfway between nuts and popcorn.

“Popcorn is a huge success story,” he said. “It’s a great example of how retailer range rationalisation shouldn’t stop manufacturers from investing in NPD.”

Crossing the Pond: US firms eyeing UK popcorn market

Snyder's-Lance

Acquired remaining shares in UK popcorn business Metcalfe's Skinny Limited this summer – after subsidiary Kettle Foods bought a 26% stake in January.

Company says it sees “tremendous growth” in the UK and opportunities for further international expansion for Snyder’s-Lance snacking brands.

“This addition to our branded portfolio provides us with another better-for-you option in a growth snacking category in the European markets,” said Snyder’s-Lance president and chief executive officer Carl E Lee Jr in July.

Amplify Snack Brands

Amplify Snack Brands – owner of second-largest US popcorn brand SkinnyPop (after PepsiCo’s top-selling Smartfood) – recently announced it is to acquire UK potato chips business Tyrrells .

Amplify has said the acquisition will give opportunities to take SkinnyPop into markets where Tyrrells operates, including Europe and Australia.

PepsiCo

This month grew its presence in the UK popcorn market with the launch of a four-strong range under the Pop Works & Company brand (see main story above).